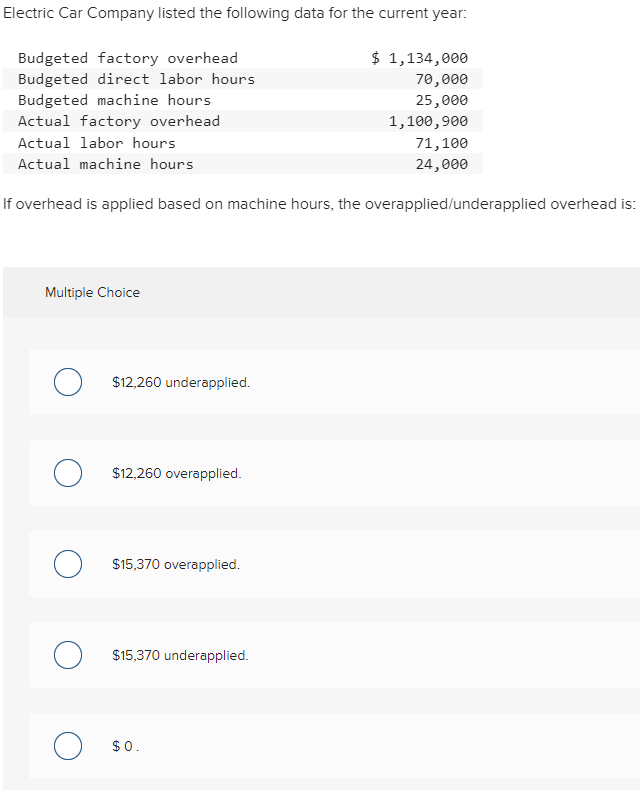

8 2 Under- or Over-Applied Overhead Financial and Managerial Accounting

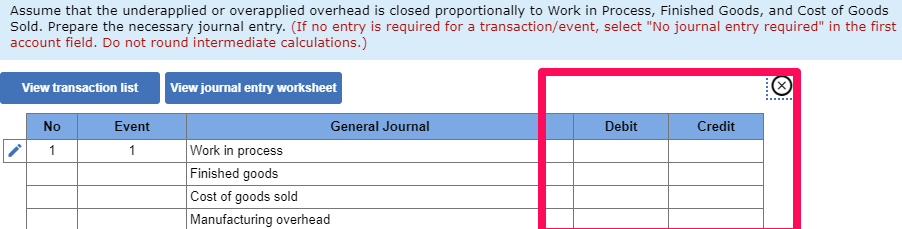

If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead. A debit balance in manufacturing overhead shows either that not enough overhead was applied to the individual jobs or overhead was underapplied. If, at the end of the term, there is a credit balance in manufacturing overhead, more overhead was applied to jobs than was actually incurred. Likewise, it needs to debit the manufacturing overhead account as in the journal entry above. If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead. Essentially, overapplied overhead means that a company has applied, or charged, less in overhead costs than it actually incurred.

Manufacturing Overhead

- This journal entry is the opposite of the overapplied overhead as the remaining balance of the manufacturing overhead, in this case, will be on the debit side at the end of the accounting period instead.

- As the manufacturing overhead applied during the period is an estimate, there is usually an underapplied or overapplied overhead that needs to be reconciled at the end of the accounting period.

- As noted above, underapplied overhead is reported on a company’s balance sheet as a prepaid expense or a short-term asset.

- Once this amount is determined, it must be removed from the accounts where it was initially applied.

- This necessitates a thorough review of the allocation bases, such as direct labor hours or machine hours, to ensure they accurately reflect the actual consumption of overhead resources.

This misrepresentation can affect various financial ratios and metrics that stakeholders rely on to assess the company’s performance. For instance, an inflated gross profit margin might suggest higher operational efficiency than what is actually the case, potentially misleading investors and management. For example, based on estimation, we credit how to file an amended tax return $10,000 into the manufacturing overhead account to assign the overhead cost to the work in process. However, the actual overhead cost which is debited to the manufacturing overhead account is only $9,500. However, during the course of the year, production is more efficient than expected, and actual overhead costs only total $950,000.

Overapplied Overhead

The opposite of overapplied overhead is underapplied overhead, which occurs when a company has applied more overhead to products than it has actually incurred. Similarly, the work in process inventory account and finished goods inventory account will also be added in the overapplied overhead journal entry. Learn effective strategies for managing overapplied overhead in cost accounting and its impact on financial statements. Over the long-term, the use of a standard overhead rate should result in some months in which overhead is overapplied, and some months in which it is underapplied. On average, however, the amount of overhead applied should approximately match the actual amount of overhead incurred. Depending on their production process, companies may express these costs as a rate per hour of machine time, a rate per hour of worker time or a per-unit cost, for example.

Our mission is to improve educational access and learning for everyone.

If the allocated overhead exceeds the actual overhead, the difference is termed overapplied overhead. For instance, if a company estimated $100,000 in overhead costs but only incurred $90,000, and allocated $95,000 based on the predetermined rate, the overapplied overhead would be $5,000. The management of overapplied overhead has far-reaching implications for cost accounting practices within an organization.

Overhead refers to indirect costs that are not directly tied to a specific activity such as manufacturing or production. These costs are typically applied to products or services using a predetermined overhead rate. When overhead has been overapplied, the proper accounting is to debit the manufacturing overhead cost pool and credit the cost of goods sold in the amount of the overapplication. Doing so results in the actual amount of overhead incurred being charged through the cost of goods sold.

Example of Overapplied Overhead

Kraken Boardsports had 6,240 direct labor hours for the year and assigns overhead to the various jobs at the rate of $33.50 per direct labor hour. Kraken Boardsports had 6,240 direct labor hours for the year and assigns overhead to the various jobs at the rate of $33.50 per direct labor hour. Job order costing and overhead allocation are not new methods of accounting and apply to governmental units as well. See it applied in this 1992 report on Accounting for Shipyard Costs and Nuclear Waste Disposal Plans from the United States General Accounting Office. After this journal entry, the balance of manufacturing overhead will become zero.

In financial terms, overapplied overhead results in a credit balance in the overhead account. This means that without the adjustment, the manufacturing overhead account will have a credit balance of $500 at the end of the period. Hence, we need to make the journal entry for the overapplied overhead of $500 by debiting that amount into the manufacturing overhead account to zero it out.

Overapplied overhead often signals that the predetermined overhead rate may need adjustment. This necessitates a thorough review of the allocation bases, such as direct labor hours or machine hours, to ensure they accurately reflect the actual consumption of overhead resources. By refining these allocation methods, companies can achieve more precise cost distribution, leading to better pricing strategies and cost control. Carbonic Corporation uses an overhead application rate that resulted in $15,000 of excess overhead being charged to produced units during its March reporting period.

If actual overhead costs per hour are given, then multiply those costs per hour by the number of hours worked. For example, the actual overhead rate for a company is $10 an hour, Therefore, actual overhead is $10,000 by the equation $10 x 1,000 hours. When underapplied overhead appears on financial statements, it is generally not considered a negative event. Rather, analysts and interested managers look for patterns that may point to changes in the business environment or economic cycle. Should unfavorable variance or outcomes arise—because not enough product was produced to absorb all overhead costs incurred—managers will first look for viable reasons.

Overapplied overhead is manufacturing overhead applied to products that is greater than the actual overhead cost incurred. Depending on materiality, overapplied overhead is either allocated between ending inventory and cost of goods sold or just written off to cost of goods sold. Subtract the budgeted overhead costs from the actual overhead costs to determine the applied overhead. Another significant implication is the need for continuous monitoring and variance analysis. Regularly comparing actual overhead costs to allocated amounts allows for timely identification of discrepancies.